ELECTION DAY IS SATURDAY, NOVEMBER 15TH!

November 15, 2025 Ballot

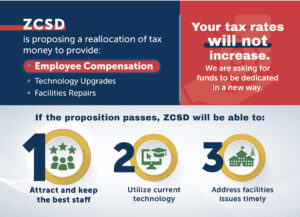

The ZCSD has placed a proposition on the ballot for November 15, 2025, to authorize the district to redirect existing school bond taxes toward critical needs in the district, without raising the current tax rate on residents.

The initiative was developed after extensive ZCSD stakeholder input and strategic planning. Stakeholder advisory groups identified these three areas as top priorities for the district. The School Board voted unanimously to place the measure on the ballot, reflecting broad support for the plan.

The proposal would authorize the ZCSD to reallocate millage from bonds as they are being paid off to fund three specified areas: employee compensation increases, technology upgrades, and facility repairs.

By reallocating the taxes residents are already paying, over time, the ZCSD can significantly raise employee salaries, update classroom technology, and fix aging school buildings.

The “Zachary Forward” initiative comes as ZCSD’s previous school construction bonds, funded by an initial 36-mill property tax, near maturity. If approved by voters, the measure would maintain the millage rate at a decreased 24 mills and dedicate it to three specified areas:

- Employee Compensation: enabling more competitive salaries and benefits to recruit and retain quality educators (neighboring districts have implemented raises, and ZCSD aims to be more competitive).

- Technology: providing a sustainable funding source for modern classroom technology and equipment replacements, ensuring students have up-to-date learning tools through predictable upgrade rotations.

- Facilities Maintenance: addressing needed repairs and upgrades in school buildings that are 10–20 years old, such as roof replacements, HVAC systems, and continued safety improvements.

The tax language ensures that this is not a tax increase, but a rededication of an existing tax. This reallocation will not increase millages past the current rate.

If you have any questions, contact the Office of the Superintendent/Communications (225-658-4969 or mandy.bradley@zacharyschools.org).

Strategic Funding Plan

(linked above)

The Zachary Community School District (ZCSD) has a long-standing tradition of excellence, consistently ranking among the top-performing school systems in Louisiana. Our success is rooted in the dedication of our educators, the strength of our academic programs, the support of our community, and the commitment to providing safe, innovative, and student-centered learning environments.

To maintain this standard and prepare for the future, the district has developed a Strategic Funding Plan tied directly to our Board approved 2025-2030 Strategic Plan (linked on our website) and the proposed dedicated tax measure. This plan outlines how voter-approved revenues will be allocated to strengthen our workforce, modernize our technology infrastructure, and maintain high-quality instructional facilities, all while protecting the programs that define our holistic student-centered approach by supporting the Three A’s (Academics, Arts, and Athletics).

The priorities in this plan reflect our core belief that investing in people and resources is investing in student success. Each priority is designed to address current challenges, anticipate future needs, and ensure fiscal accountability to the taxpayers of Zachary. Tax plan funding benchmarks must be met for Priority 1 before funding for Priority 2 and Priority 3 is considered for allocation.”

FREQUENTLY ASKED QUESTIONS

Yes, it is “new” because we are asking for funds to be dedicated in a new way, but your tax millage rates will not increase beyond the current millages you will pay this year. This is NOT an increase in the tax rate. The proposal is to continue collecting property millage that is already in place from bonds that are being paid off and use that money for other needs in the school district.

In short, you will pay the same property tax rate you pay now. But instead of money rolling off after the bonds are paid each year, any leftover funds will go into teacher pay, technology, and school maintenance, in that order.

A millage is a property tax based on property’s assessed value. Your home’s assessed value is 10% of its estimated property value, as determined by the parish assessor’s office. One mill is 1/1000 of a dollar, so a millage rate is the number of dollars you pay for every $1,000 of your property’s assessed value. In Louisiana, most homeowners have a homestead exemption on their property which reduces the impact of millages. If you have a home valued at $250,000, the millage applies only to the portion that is not exempted. This means the millage would be applied on $175,000 instead of $250,000. To calculate your millage tax, divide your property’s assessed value (without the exempt amount) by 1,000 and multiply that by the millage rate. A home valued at $250,000 with a homestead exemption would start this math at $17,500; dividing that by 1,000 = $17.5 and multiplying that by 24 mills = $420 a year.

When our district was first established, the major need was for facilities. Since then, our success has been rooted in the dedication of our educators, the strength of our academic programs, the support of our community, and the commitment to providing safe, innovative and student-centered learning environments. Today we face new challenges to maintain our model of excellence. To proactively address this, our strategic planning teams have proposed a dedicated tax measure to support three critical needs:

- Employee Compensation: First and foremost, funds collected will give teachers and support staff a much-needed raise so we can attract and retain high quality employees. Our salaries must stay competitive with other districts to maintain the excellent education our children receive. In addition, our benefits packages must remain strong for both current and retired employees.

- Technology Updates: Regular updates are required for classroom technology for students. This funding will ensure our students, teachers, and staff have modern tools for learning as technology continues to evolve rapidly.

- Facility Repairs: Remaining funds may be used to fix and update aging school buildings. Many of our facilities are currently 10-20 years old and over time will require major maintenance that may exceed what the annual budget can cover, like roofing, HVAC, security improvements, etc.

Without this measure, there’s no dedicated funding for these needs, and we risk falling behind our high standards or shifting funds away from other programs to focus on priority areas. To view the full strategic funding plan, visit our plan here.

The tax election in November 2025 will ask for a 20-year term, but the School Board is able to lower the millage rates each year as needed. After those 20 years, the public would need to vote again on the proposal if it is needed.

Yes. Since 2003, the School Board has adjusted the millage rates down overall to 85% of the original millage rates. In 2003, Zachary Community School District residents had millage rates of 79.2 mills assessed for schools; in 2025, millage rates are at 67.2 overall. The 24-mill proposition is part of those 67.2 mills.

The first priority of this measure is to maintain our model of excellence with additional support to quality teaching and support staff. Secondarily, funds can be used to uphold evolving technology needs. The third possible use of funds generated from this measure will be to allow the district to stay ahead of needed facility repairs so that our buildings can last far into the future.

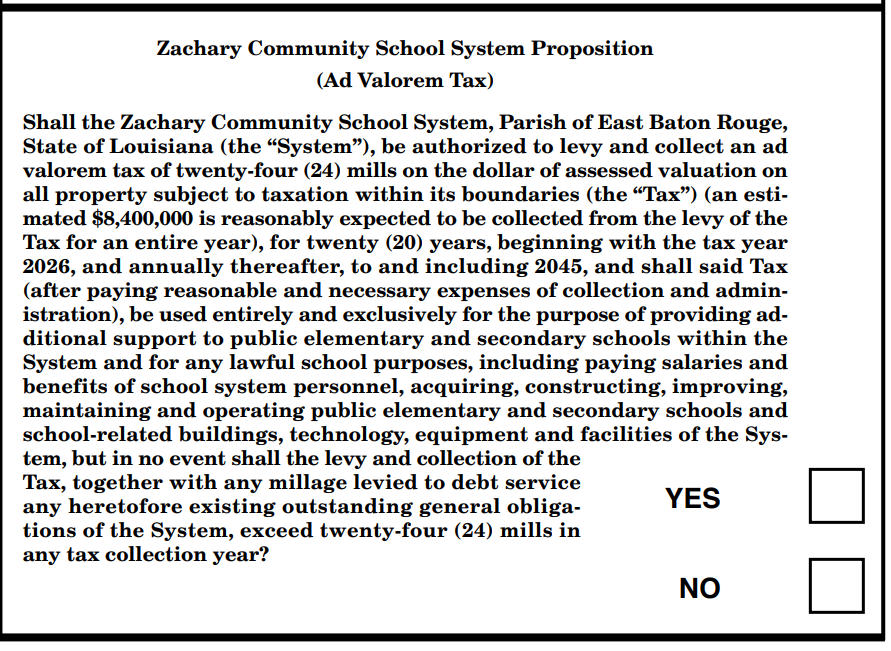

The ballot will have a proposition explaining the rededication of 24 mills (the exact rate currently levied for bonds) for the stated purposes (employee salaries, technology, facilities). It will mention the duration of the rededication and that it does not increase the millage rate. The wording can be a bit technical, which is required by law. The ballot will phrase the proposition as a question, essentially asking if you support allowing the school board to use the existing mills for the purposes of staff salaries, technology advancements and building maintenance.

Voting “yes” means you agree to this proposed way of adjusting tax dollars so the community can provide additional support to the school district. Voting “no” means you do not want to give more money to the school district.

We will provide a sample ballot on our website when it becomes available.

If the measure fails, the current bond tax will expire as the bonds are paid off, which should be eight years from now. Taxpayers will eventually see a decrease in their property tax rate. However, the school district will lose future funding that would have to be cut or found elsewhere. The likely result is:

- School staff will receive very minimal or no raises at all. The impact of that will make it significantly harder to recruit and retain the best staff, resulting in a possible decline in the quality of education and extracurricular activities for our students. Additionally, staff benefits will likely also be reduced.

- Technology purchases may be limited; students might have to use outdated equipment longer and pay fees.

- Some facilities projects may be deferred; small issues could grow into bigger, more expensive problems. The district might have to dip into emergency funds or cut programs to fix critical failures. To continue to be competitive with employee pay and be good stewards of our facilities and budgets, programs, or other areas that may need to be reduced or cut to support priorities.

In short, saying “no” would provide a tax break in a few years at the potential cost of educational quality and potentially higher costs later (if large capital projects are needed).

If approved, the existing bond millage could continue without dropping off, and those tax proceeds would start going into a special fund for the three purposes, starting with next year’s property taxes. The district would then implement plans to distribute that funding: for example, enacting salary increases (likely in phases or effective on a certain date), setting up a technology upgrade schedule and scheduling priority maintenance projects at schools. The community would see the impact in the form of improved employee morale and recruitment, and retention of high-quality employees. The benefits would be seen/felt immediately with more competitive pay, timely repairs, new technology in classrooms, and improved facilities. Essentially, it secures stable funding for these areas moving forward.

The proposal keeps the tax rate at the current level or lower. The School Board would have the flexibility to roll millages back if additional funding were available in the future. For example, if a large industry moved to our area and substantial new taxes were realized, the School Board could reduce millage usage and provide taxpayers with a lower rate.

Good schools benefit everyone in the community, not just those with children. Quality schools keep property values high, attract families and businesses to the area, and produce educated graduates who contribute positively to the community. Also, since this measure doesn’t raise taxes, it maintains community assets (schools and an educated workforce) with no extra cost.

Voting “yes” is an investment in Zachary. If the schools decline, it will negatively impact the whole city. The health and progress of our whole community is at stake

The ballot measure legally restricts the funds to the specific purposes listed (employee compensation, technology, facilities). By law, the school district must account for those funds and use them only for those categories. Additionally, the School Board participates in yearly audits that provide external transparency on the use of public funds. In addition, the board approved a detailed priority plan to guide the use of the funds at their September 2025 board meeting pending passage of the tax initiative. Click this link to view the plan: Click this link to view the plan

The community can also see results: for instance, announced pay raises, technology purchases made, and a list of maintenance projects completed. ZCSD has a proven track record of responsible financial stewardship. Voters can trust that the funds will go exactly where they are promised.

The district’s budget is already lean, directed mostly toward basic operations and instruction. Teacher salaries are currently funded through state allocations and existing local taxes, but those sources are not keeping pace with rising costs and competitive pay levels. We have pursued grants and state funds for technology and facility needs when possible, but those are not sufficient or reliable year to year. Major facility repairs are very expensive and can’t always be handled within the routine maintenance budget without a funding source for long-term maintenance. The stakeholder advisory groups looked at options and strongly recommended this approach as without this rededicated tax, the district would likely have to either go without these improvements or come back in a few years asking for additional funds. The reallocation is the prudent path that avoids cuts, and a bigger tax ask later.

Zachary has a tradition of providing students with opportunities in academics, arts, and athletics, and has worked hard NOT to make cuts in these areas, as many other districts have. ZCSD knows the importance of these programs to our families, as well as the community’s tremendous support and belief in these programs. Excellence in these areas has made Zachary a fantastic place to receive an education. However, many of these programs are seen as supplemental and could be cut in the measure fails to offset raising cost, maintain benefit packages, or provide minimal compensation increases.

The ZCSD recently conducted a five-year demographic study (2025-2030) to assess the population impacts on the ZCSD. The study concluded that the student population of the ZCSD will remain steady and only deviate by about 100-150 students in the next five years. Potential overcrowding is not a concern at this time.

Our district maintains athletic facilities and pays the salaries of our coaches. All other resources come from fundraising, sponsorship, and income from ticket sales that athletic teams use to support their needs. Actually, we are one of only a few districts that don’t support athletics at the district level.

A. This tax is already being paid by property owners at 27 mills. In the next year, the tax rate will actually decrease from 27 mills to 24 mills. If the voters agree to the reallocation of mills, the tax rate for these millages will stay at 24 mills and not go higher, with the potential of going down in the future. Your property millages will be less next year! For example, if your assessed home value is $250,000, then the cost of the 24 dedicated mills is maintained at the rate of approximately $420 per year or $35 per month. (Reducing debt service from 27 mills to 24 mills is a savings of $53 for a home valued at $250,000 or $98 for a $400,000 home.)

B. If your assessed home value is $400,000, then the cost of the 24 dedicated mills is $780 per year or $65 per month.

C. The board can elect each year to roll back millages not needed that year, so your property taxes could potentially go down if other funding sources are realized.

Your total millages would not go higher than 67.20 total mills, but your home’s assessed value could increase, which would cause a taxpayer to pay more $$$. This is ONLY done by the assessor.